Why Elon Musk bets on Lithium-ion Battery?

Tesla Gigafactory is under construction. Elon musk decided to bet all his fortune on eneryg storage system. Annual estimated production of Gigafactory is 35Gwh, which is as large as the sum of all battery manufactured in 2013. Even if other competitor also expand battery manufacturing, the investment is too much risky. What if there is a new battery breakthrough magic battery(1Mwh/kg energy density,10,000,000 charge times). Tesla will not able to switch their strategy because initial investment is too high. Elon Musk is confident that lithium-ion is the future of the next battery system.

Why Elon Musk bets on Lithium-ion Battery?

Advantage/Drawback of Lithium-ion Battery

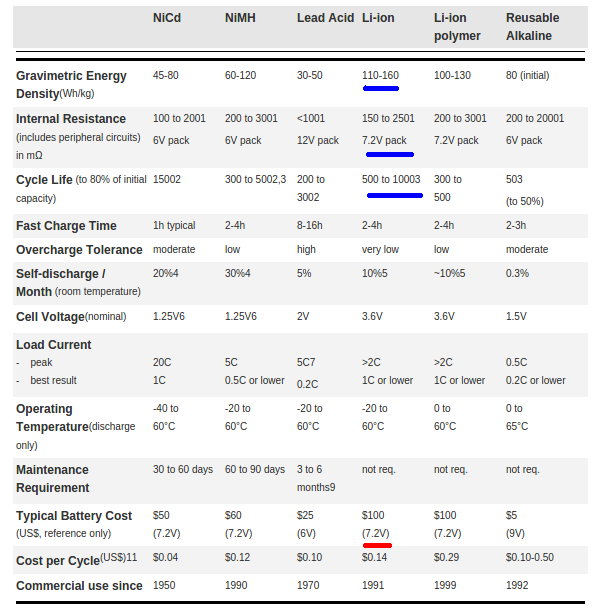

There are 6 major battery types in the World.(The basic reference: batteryuniversities) For many years, nickel-cadmium dominated the world. Nickel-metal-hydride and lithium-ion emerged in the early 1990s. Nowadays, lithium-ion is dominant and the fastest growing technology. The reason is simple: lithium-ion has a high quality.

- High energy density : Energy density of lithium-iοn is the highest among batteries. Lithium-ion is the most efficient battery among commercialized battery. The basic voltage of lithium-ion is relatively high ; it means one cell of lithium-ion can transfer larger amount of electric power.

- Long durability : Lithium is durable. The performance of rechargeable battery goes down every time it charges. Li-ion can maintain 80% performance for 500 to 10,003 charge times. Also, the self-discharge rate is low; batteries discharge in the certain rates. The discharge rate is relatively low in lithium-ion. Lithium-ion has a long durability.

There are also drawbacks of lithium-ion, but lithium-ion technology is rapidly overcoming the drawbacks.

- Expensive price : High quality usually brings high cost of manufacturing. The tables above, the price of lithium-ion is 2–4 times more expensive than other competitors. One battery cell consists of different parts: anode and cathode materials, the battery separator, electrolyte, etc. Cost-driver is ‘anode/cathode’: it uses cobalt which is quite rare metal. It accounts for 50% of battery cell price. Recently the new cathode technology developed such as lithium iron phosphate. (Reference: The Cost Dilemma: Why Are Batteries So Expensive?) The experience curve and economic of scale also drive cost-reduction of lithium-ion. The price drop of lithium is steep comparing to other batteries. After Gigafactory established, JB Straubel(CTO of Tesla) predict that the price of battery could lower to 185$ for kwh.

- Safety problem: There is a possibility that lithium-ion explode. Lithium- ion is consists of electrolyte(liquid). In electrolyte, (+,-) is divided by seperator. If the battery is overheated or overcharged, the seperater could break down and +,- are mixed together; this can cause explosion. Therefore, every lithium-ion batteries contains protection circuits. The protection technology is developing in fast speed.

The battery breakthrough

Is there other “on going” batteries in the lab that can disruptive enough to substitute lithium-ion battery technology? If lithium-ion battery can be substituted in 10 years, Tesla investment could be too risky. However, Elon Musk is quite confident that there In batteryuniversities, there is a clear argument of battery breakthrough.

Whereas the Moore’s Law doubled the number of transistors in an integrated circuit every two years, the capacity gain of Li-ion during the last two decades was only about eight percent per year. There will be further improvements but not without potential higher fragility, lower durability and shorter life.

The development speed of battery is really slow and has not been accelerated: fixed to 8 percent. Lithium-air, lithium-sulfur, lithium-metal suggested to be the breakthrough; they are still not commercialized. Musk is talented CEO, he knows difference between lab and market. Low portion of demonstrated technology comes to market. Even if the technology is brought to market, it takes long years to mass commercialization.

“My top advice really for anyone who says they’ve got some breakthrough battery technology is please send us a sample cell, okay. Don’t send us PowerPoint, okay, just send us one cell that works with all appropriate caveats, that would be great. That sorts out the nonsense and the claims that aren’t actually true.”- Elon Musk in Q3 shareholder meeting-

Efficiency of Gigafactory

Rather than new technology, Elon Musk bet on efficiency from ‘economic of scale’ and ‘learning curve’. Tesla expect to reduce 30% of battery cost by Gigafactory.

In Space X Elon Musk reduce cost by simple module production.Space X uses the same rocket engines for all Falcon rockets. Tesla announced in AA battery(lithium-ion 18600) will be produced; no other battery type has been mentioned.

What if Gigafactory only produce 18650 and get a huge amount of economic scale. The various product can be made with compound of 18650 battery. Tesla already have battery management system in EV; using 6000–8000 18650 battery. It can take a huge amount of economic scale.

Will Musk’s betting success?

I don’t know. But it is clear that Musk is the most aggressive investor in clean tech industry. Musk is approaching battery problem in the market’s view: not academia’s view. It might be the biggest clean tech experiment we have ever faced.